Identifying leading enterprises within the sustainable power sector involves examining firms demonstrating robust financial performance, technological innovation, and commitment to environmental stewardship. These entities often possess diversified portfolios across various renewable technologies like solar, wind, hydro, and geothermal, contributing significantly to the global transition towards cleaner energy sources. Examples include manufacturers of solar panels, developers of wind farms, and operators of hydroelectric power plants.

Investment in this segment of the market offers the potential for long-term capital appreciation, driven by increasing global demand for alternatives to fossil fuels and supportive governmental policies. Historically, renewable energy investments have shown resilience during periods of economic uncertainty, showcasing their potential as a hedge against traditional energy market volatility. This sector’s growth is pivotal in mitigating climate change and fostering energy independence.

The following analysis will delve into specific factors to consider when evaluating businesses in the environmentally-friendly energy space, exploring key performance indicators, competitive landscapes, and potential risks associated with investing in this burgeoning sector. Understanding these elements is crucial for informed decision-making in the context of sustainable investing.

Considerations for Selecting Leading Sustainable Energy Investments

Prudent investment decisions within the renewable energy sector necessitate a thorough assessment of various factors. These guidelines aim to assist investors in identifying potentially promising companies.

Tip 1: Evaluate Technological Diversification: Analyze the company’s portfolio across various renewable technologies. A diversified approach mitigates risk associated with the performance of a single technology, such as solar or wind.

Tip 2: Assess Financial Stability: Examine key financial metrics, including revenue growth, profitability, and debt levels. A financially stable company is better positioned to withstand market fluctuations and invest in future growth.

Tip 3: Investigate Research and Development: Scrutinize the company’s commitment to innovation and technological advancement. Companies investing in research and development are more likely to maintain a competitive edge and adapt to evolving market demands.

Tip 4: Analyze Market Position: Determine the company’s market share and competitive advantages within its specific niche. A strong market position provides a foundation for sustainable growth and profitability.

Tip 5: Review Regulatory Landscape: Understand the regulatory environment in which the company operates, including government subsidies, tax incentives, and environmental regulations. Favorable regulatory conditions can significantly impact a company’s financial performance.

Tip 6: Gauge Management Team Competence: Evaluate the experience and expertise of the company’s management team. A strong management team is crucial for strategic decision-making and effective execution of business plans.

Tip 7: Consider Environmental Impact: Assess the company’s commitment to sustainability and environmental responsibility. Companies with strong environmental performance are more likely to attract environmentally conscious investors and maintain a positive public image.

Adhering to these guidelines can assist in the selection of environmentally conscious energy investments, fostering both financial returns and environmental progress. The subsequent sections will explore specific company examples and further refine the investment decision-making process.

1. Financial Performance

For example, consider a solar panel manufacturer with a history of steadily increasing revenue and a robust profit margin. This indicates efficient operations and a strong market demand for its products. Conversely, a wind farm developer burdened with excessive debt and inconsistent revenue streams presents a higher risk profile, potentially hindering its ability to secure future financing or capitalize on emerging opportunities. The relationship is causal: positive financial performance enables growth and stability, while poor performance jeopardizes a company’s future.

In summary, a thorough analysis of financial statements, including revenue growth, profitability, debt levels, and cash flow, is essential for identifying leading environmentally-conscious energy investments. While other factors such as technological innovation and regulatory compliance are also important, strong financial performance serves as a foundational indicator of a company’s potential for long-term success and shareholder value creation.

2. Technological Innovation

- Enhanced Energy Conversion EfficiencyImprovements in energy conversion efficiency, such as advancements in solar cell technology or wind turbine blade design, directly translate to higher energy output from renewable sources. For example, companies developing perovskite solar cells, which offer potentially higher efficiencies than traditional silicon-based cells, stand to gain a significant competitive advantage. Increased efficiency lowers the cost per unit of energy produced, improving profitability and accelerating the adoption of renewable energy technologies.

- Advanced Energy Storage SolutionsThe intermittency of many renewable energy sources, such as solar and wind, necessitates the development of effective energy storage solutions. Companies pioneering advanced battery technologies, pumped hydro storage, or thermal energy storage are crucial for ensuring grid stability and enabling the widespread integration of renewable energy. Innovations in energy storage address a key limitation of renewable energy, increasing its reliability and attractiveness as a baseload power source.

- Smart Grid Integration and OptimizationIntegrating renewable energy sources into existing power grids requires sophisticated technologies for monitoring, controlling, and optimizing energy flow. Companies developing smart grid technologies, such as advanced metering infrastructure (AMI) and distributed energy resource management systems (DERMS), play a vital role in ensuring the efficient and reliable distribution of renewable energy. Smart grid solutions enhance grid flexibility, reduce transmission losses, and enable the integration of a greater proportion of renewable energy into the grid.

- Materials Science BreakthroughsAdvancements in materials science contribute to the durability, longevity, and performance of renewable energy components. Innovations such as lightweight, high-strength composite materials for wind turbine blades or corrosion-resistant coatings for offshore wind infrastructure extend the lifespan of renewable energy assets and reduce maintenance costs. These materials science breakthroughs enhance the overall economic viability and sustainability of renewable energy projects.

In conclusion, technological innovation is inextricably linked to identifying leading firms within the sustainable energy investment space. Companies at the forefront of technological advancements are poised to capitalize on the growing demand for clean energy and deliver superior returns to investors. A rigorous assessment of a company’s research and development efforts, technological capabilities, and track record of innovation is therefore essential for making informed investment decisions in this dynamic sector.

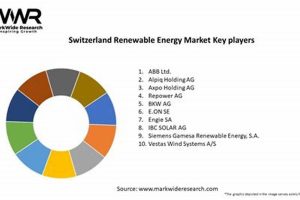

The practical significance of understanding market share lies in its ability to predict future performance. Companies with a commanding presence in specific segments of the renewable energy market, such as wind turbine manufacturing or solar farm development, are often better positioned to capitalize on industry growth trends. Consider Vestas, a leading wind turbine manufacturer with a significant global market share. Its established presence and technological expertise enable it to secure large-scale contracts for wind farm projects worldwide, generating substantial revenue and solidifying its position as a key player in the renewable energy transition. Such companies also possess the resources to invest in research and development, further enhancing their competitive advantage and ensuring long-term growth.

In conclusion, market share provides valuable insights into the competitive landscape and the relative strength of companies operating within the renewable energy sector. While it is not the sole determinant of investment success, a significant market share, coupled with strong financial performance and technological innovation, often signifies a promising investment opportunity. Challenges remain in accurately assessing market share in rapidly evolving renewable energy sub-sectors, requiring careful analysis of market reports, industry trends, and company-specific data. However, understanding the importance of market share remains essential for informed decision-making in the context of sustainable investing.

4. Regulatory Environment

Leading companies in the renewable energy sector demonstrate a strong understanding of the regulatory landscape and actively engage with policymakers to shape favorable policies. This strategic engagement allows them to anticipate regulatory changes, adapt their business models accordingly, and capitalize on emerging opportunities. For example, companies developing offshore wind farms must navigate complex permitting processes and environmental regulations, requiring close collaboration with government agencies and stakeholders. Successful navigation of these processes can provide a significant competitive advantage and unlock substantial investment opportunities. The practical significance lies in the ability of businesses to leverage policy mechanisms to enhance financial returns and reduce project risks. A deep understanding of the political landscape and regulatory nuances is thus indispensable for businesses aiming to thrive within this sector.

In conclusion, the regulatory environment is a critical determinant of investment success in the renewable energy sector. Businesses that effectively navigate regulatory complexities and engage proactively with policymakers are better positioned to achieve long-term growth and profitability. Challenges persist in ensuring consistent and predictable regulatory support across different jurisdictions, necessitating careful due diligence and risk management strategies. However, recognizing the crucial interplay between policy and investment remains essential for fostering a sustainable and thriving renewable energy industry.

5. Sustainability Practices

The practical significance of understanding this connection lies in the ability to identify companies that are not only contributing to the transition to a clean energy economy but are also building resilient and responsible businesses. Investors increasingly prioritize companies that demonstrate a commitment to environmental, social, and governance (ESG) factors, recognizing that these factors can significantly impact long-term financial performance. For instance, companies that implement comprehensive waste management programs, reduce water consumption, and promote diversity and inclusion within their workforce are better positioned to attract and retain talent, improve operational efficiency, and mitigate environmental risks. By integrating sustainability considerations into their investment decision-making process, investors can not only generate financial returns but also contribute to a more sustainable and equitable future.

In conclusion, sustainability practices are not merely a peripheral concern for renewable energy companies but rather a core driver of long-term value creation and investment attractiveness. Companies that prioritize environmental stewardship, social responsibility, and ethical governance are more likely to achieve sustained financial success and contribute to a more sustainable and resilient energy system. However, challenges remain in standardizing sustainability metrics and ensuring transparency in reporting. Continued efforts to improve ESG data and promote greater accountability are essential for fostering a truly sustainable and responsible renewable energy industry.

Frequently Asked Questions Regarding Renewable Energy Investment

This section addresses common inquiries concerning investment opportunities within the renewable energy sector, providing clarification and guidance for prospective investors.

Question 1: What constitutes a best company for renewable energy investment?

Leading companies in this sector typically exhibit a combination of strong financial performance, technological innovation, significant market share, favorable regulatory positioning, and robust sustainability practices. These factors contribute to their long-term viability and potential for generating shareholder value.

Question 2: What are the primary risks associated with environmentally conscious energy investments?

Risks include technological obsolescence, fluctuating commodity prices, regulatory changes, project delays, and macroeconomic factors. Careful due diligence and diversification can mitigate these risks.

Question 3: How does one evaluate the technological innovation of a renewable energy company?

Evaluation involves assessing the company’s research and development efforts, patent portfolio, adoption of cutting-edge technologies, and track record of successful innovation. Review of technical specifications and independent verification of performance claims are also advisable.

Question 4: What role does government policy play in shaping the attractiveness of renewable energy investments?

Government policies, such as tax incentives, subsidies, feed-in tariffs, and renewable portfolio standards, significantly influence the economic viability of renewable energy projects. A stable and supportive regulatory environment is essential for attracting investment and fostering growth in the sector.

Question 5: How can investors assess the sustainability practices of renewable energy companies?

Assessment involves evaluating companies’ environmental impact, social responsibility, and governance practices. This includes reviewing their environmental policies, waste management programs, community engagement initiatives, and corporate governance structures. ESG (Environmental, Social, and Governance) ratings can provide additional insights.

Question 6: What is the typical investment horizon for renewable energy projects?

The investment horizon for renewable energy projects is typically long-term, ranging from 10 to 30 years or more. This reflects the capital-intensive nature of renewable energy infrastructure and the need for sustained operation to generate returns.

The preceding responses highlight key considerations for navigating the environmentally conscious energy investment landscape. Diligence and a multifaceted evaluation are essential for informed decision-making.

The next section will provide actionable strategies for building a diversified renewable energy portfolio and mitigating potential investment risks.

Conclusion

The exploration of elements relevant to discerning leading businesses within the renewable energy domain reveals that success hinges upon a confluence of factors. Sound financial standing, a commitment to pioneering technologies, a secure market presence, skillful navigation of regulatory frameworks, and a dedication to sustainable operational models are crucial. The entities exhibiting these characteristics offer the most promising avenues for investment in the burgeoning environmentally-conscious power sector.

As the global imperative for sustainable energy solutions intensifies, the significance of informed investment decisions within this sector cannot be overstated. Continuous monitoring of industry trends, regulatory developments, and technological advancements remains essential for capitalizing on opportunities and mitigating risks. The future of energy rests, in part, on the strategic allocation of capital towards those businesses poised to drive innovation and deliver lasting value in a rapidly evolving landscape. Further research and diligent evaluation are encouraged to build investment portfolios aligned with both financial objectives and a commitment to environmental stewardship.